Ever wonder how firms like Uber, Paypal, and Facebook got their start as business entities? Well, after their founders came up with the necessary software to get these tools up, it wasn’t a bed of roses right away. These company founders still need to find a way to make sure that their business idea becomes sustainable on a much larger scale. For a wider selection of agreement templates, check out more options here.

To do that, startups need to look for funding to cover the business operating costs and also to continue serving their growing customer base. This is where venture capital firms and their funds come into play. But in order to formalize the partnership between the startup founders and the venture capital firm, a venture capital agreement sample needs to be created and signed.

share subscription agreement for venture capital template" width="530" height="500" />

share subscription agreement for venture capital template" width="530" height="500" />

Download our above-shown template in order to create a simplified share subscription agreement template in Word for your venture capital. Using this, you will be able to present information relating to the share’s sales purchase price for your company. You will also be able to show the representations of each party being a part of the agreement. Bind the parties that are involved in the agreement editing and customizing this simple yet effective agreement in any of the available file formats.

Are you willing to offer funds for small startup companies that have a huge potential for growth? If so, then make use of our premium “Offer to Purchase Shares Agreement Venture Capital” template as it will help you define the terms and conditions of buying shares of such startup companies. Easily edit and customize this important agreement document so that you can help out emerging businesses while making a profit at the same time!

Make use of our expertly designed Sale of Shares Agreement template in Apple Pages in case you are selling your shares of the business or company. This document comes with ready-made content that lets you define the terms and conditions of the sale of your specified shares. Be able to state warranties and their accompanying limitations along with the purchase price and delivery of sales. Download it now in any file formats so that you can make your agreement in a matter of minutes.

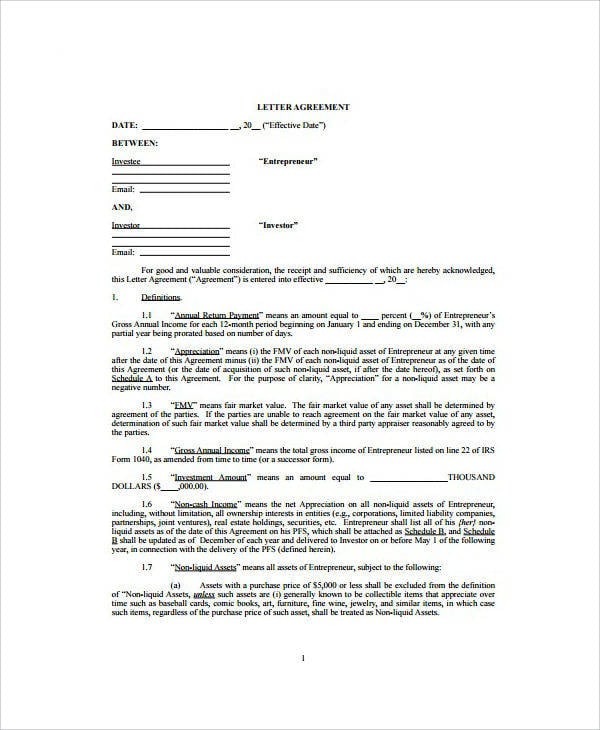

An agreement is a document that binds two or more parties for the fulfillment of a specific goal. When used in business, written business agreements tend to be used as a way to ensure compliance with the specific terms agreed upon by two parties.

When a venture capital agreement is created, it obviously means that the contract is between a business or startup owner/s and a venture capitalist. These types of basic agreements are usually created at the beginning stage of a startup’s life and, therefore, will include specific terms that will benefit both parties in the long run. Most of the time, venture capital agreements are needed in order to jumpstart a new company after a few rounds of funding. These specific kinds of agreements are usually used in the tech industry and other related fields. Be sure to take a look and review each of the sample agreement templates embedded within this article. Use them as a guide when it comes to creating your own venture capital agreement.

cloudfront.net

File Format

mcgoverncenter.cornell.edu

File Format

turquoisehill.com

File Format

elsevier.com

File FormatIn this article, we have presented multiple examples of venture capital agreement templates so that anyone may find it easy to download and customize. Furthermore, we have mentioned tips on how to create the best venture capital agreement for small business or startup are also included below.

allbusiness.com

File FormatAs with any kind of business agreement, venture capital agreements also need to be crafted with the guidance of a lawyer. But this does not have to stop you from independently making sure that you are agreeing on the best offer for your startup business. To help you check if a venture capital agreement is favorable to you and your business, we have listed down a few tips on how to do that below.

Read each tip and keep them in mind when it’s time for you to final draft and review your own venture capital agreement template.

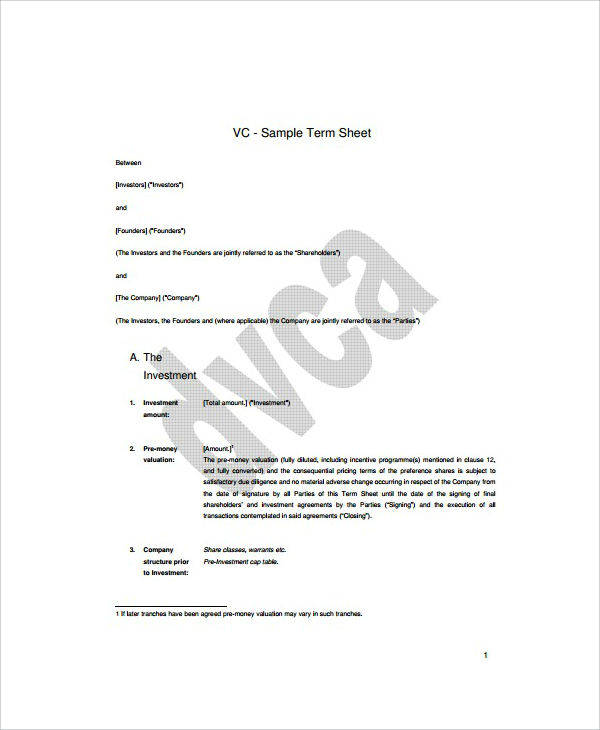

A term sheet is the preliminary framework of the most important components of a venture capital agreement. It will usually include the most basic terms of the investment agreement like who will control the company, its valuation, investment types, etc. The parties involved will need to first see and agree with the basic terms and stipulations on the term sheet before they come up with the final venture capital agreement.

Therefore, when you create an investment contract like a venture capital agreement, you should use term sheet details as the basis of the general agreement. Once you have fully incorporated all the details of that term sheet, you will most likely have a mutually beneficial venture capital agreement on hand.

Another useful thing to do while preparing for the completion of the final venture capital agreement for your startup company is to familiarize yourself with the most frequently used business and legal terminology. This small skill will prove useful when you are reviewing the legal agreement yourself.

Also, always remember that you should still consult a licensed attorney and heed his or her advice before agreeing with or changing the terms of the venture capital agreement.

As we have mentioned earlier, venture capital agreements are legal and binding documents that will formalize the relationship between an emerging company and a venture capital firm. Therefore, these kinds of agreements are also bound by any government rules or mandates implemented where the agreement was signed or created.

To ensure that a venture capital agreement is valid and duly recognized by government institutions, entrepreneurs and investors alike, it pays to adhere to any legal business regulatory policies or laws. By doing this, you are helping build a strong foundation for your own business—something that will benefit you and your company in the long run. You may also like framework agreement templates.

Earlier, we have mentioned that the preliminary term sheet created for any kind of business investment transaction is needed before a final and executory venture capital agreement is created and signed by both parties. The term sheet will usually also contain a company’s valuation amount. This is the amount of money each stock of your company is potentially worth.

When you have this piece of information on hand, you may leverage this in order to get a better deal investment deal from any venture capital. For example, when you know your company’s worth and potential for more earnings, you may ask for or insist on better terms of the contract from any investors.

As discussed earlier, you entrepreneurs should not solely rely on their own knowledge and common sense when it comes to interpreting the terms of a venture capital agreement (or any kind of legal agreement for that matter). Emerging businesses and companies should make sure that they hire a good securities attorney or banker who can negotiate better business funding deals for them.

Also, remember that it may take multiple funding rounds before a business can fully stand on its own without needing financial aid from outside sources. So to avoid overextending your company’s finances before your product or service launch or the introduction of new services, you will likely need a good securities attorney who can draw up better loophole-free and mutually beneficial agreements that will work long term.

When creating a venture capital agreement, business founders and owners should also pay attention to the actual daily operations of the business. A professionally-written venture capital agreement and business plan will not work in case you do not have a skilled management team who will implement all your business strategies and see to it that the terms of the investment agreement are exercised.

This is the reason why we have included this tip. Business owners and founders should make sure that a good team is created to oversee the company’s beginnings if they are not the ones who will be running the business’ day to day operations. You may also like service agreement templates.

Another helpful tip that new businesses should follow when drafting or evaluating their own venture capital agreement is the inclusion of an exit strategy on the agreement details. Having an exit strategy may simply mean the inclusion of specific verbiage on how a venture capital firms and other investors can divest their capital and when they can do this. Of course, the more complex your business structure and plans are, the more complex an investment exit strategy can get.

Remember, it is a risk for investors to fund new and emerging business ideas and help take them to the market. A good venture capital agreement, therefore, should include stipulations that will benefit the investors during whatever business milestones or stagnation periods it faces.

When creating a venture capital agreement, some businesses and investors may ask to also have a non-disclosure and/or a confidentiality agreement included in the general venture capital agreement. This additional rider agreement or stipulation is often necessary if one or two parties want to keep the details of the partnership a secret. You can also check out employment agreement templates.

That is why when you are drafting or reviewing a venture capital agreement, you should also look into the non-disclosure and confidentiality agreement incorporated in the general agreement. Read it carefully and ask your lawyer for clarification on what you can and cannot do under that agreement.

And that ends this short list of tips that every new entrepreneur or business owner should follow when working with a venture capital agreement. We hope that you have learned a lot from this short article and help increase the chances of your new business idea succeeding in this market.

eclass.aueb.gr

File Format

emergentfool.com

File FormatThis article aims to provide you with useful knowledge on how to create, or at least, craft a well-written venture capital agreement. As we have reiterated earlier, you do not have to create a venture capital agreement yourself. You just have to know for yourself how to read and review this kind of business agreement so that you can make better business decisions in the future.

If you want to learn more about different kinds of printable business agreement templates, be sure to check out the rest of our website!